12 Stats About Brand To Make You Look Smart Around The Water Cooler

The 10-Second Trick For Types Of Invoices

Table of ContentsThe smart Trick of Invoicing Features That Nobody is Talking AboutThe Ultimate Guide To Mobile Invoice Maker AppMobile Invoice Maker App Can Be Fun For AnyoneFascination About Create InvoicesRumored Buzz on Types Of Invoices

How Invoice Maker can Save You Time, Stress, and Money.

How Invoice Maker can Save You Time, Stress, and Money.

https://www.youtube.com/embed/O6qtAT_SnIM

Invoices can be erased at any time! Here's how: Click the invoice to view it. Once the billing is open, you'll see 3 buttons at the top of the screen: and, as shown listed below. Click. Deleted billings and other erased files can not be retrieved. Ensure to download the file as a PDF prior to deleting if you wish to keep it for your records.

They can stay in the system to indicate you've billed the customer. If invoices aren't developed for a session, the session charge will not belong to the customer's balance and payments will result in a credit balance. Yes, in order to utilize the billing features of SimplePractice, you'll require to use invoices.

Lots of SimplePractice consumers wish to include sales tax to their billings. While this is something that our program can not presently determine immediately, you can develop a Sales Tax "Item" which can be added to any invoice. First, go to and include a new item for Sales Tax with a description that works for you.

The Facts About Mobile Invoice Maker App Revealed

Now go back to your customer's profile and create an Invoice. Click to tailor the billing and the button to enter your sales tax line product. Click to consist of the Sales Tax Product you produced. Then click to go back to the billing. Next, calculate and enter the proper amount of the sales tax based upon the cost in the filed and click at the top of the invoice.

Some consumers choose to pass along the charge card processing costs to their customers. In some states this practice is prohibited, so validate the laws that govern card approval in your state before you add fees to your credit invoices. Here is how to include the processing charge to a client billing: That's it! Now your billing consists of a credit card processing cost.

You can access and make a copy of it from here: Customers typically ask us for suggestions about the legality of this practice (i. e., passing charge card fees on to clients). The very best method to get a response to this question is to ask an attorney. However, we can supply some info that is commonly available on this problem.

The Ultimate Guide To Invoice Generator

Please keep in mind that this is basic info just and we do not intend for you to utilize any of it as legal suggestions or assistance. Nor do we plan for you to use it in lieu of seeking appropriate legal counsel. If you set the customer's appointment fee incorrectly or you decide to change the charge for your client, you might require to erase and recreate billings for these appointments.

The billing will show $100 due for the appointment. But, what if you implied to charge the client $80 for this visit? If you modify the consultation fee and alter it to $80, the invoice will not automatically alter to $100. The system thinks you are making a change so it creates an adjustment invoice with a $20 credit.

These extra invoices can be puzzling if you didn't mean to expense that method. Let's walk through the proper steps, which will leave you with a cleaner billing page. For the appointment that isn't billed correctly you can pick one of 2 alternatives:. You are fixing the invoice due income to the fact that it shows the incorrect fee and you just intend to bill the customer $80 (this is the most common scenario): Navigate to the client's billing overview page, and click the billing listed next to the visit in the visit line and click in the top right corner.

Excitement About Detailed Invoice

Click under the consultation cost. Update the consultation cost (from $100 to $80). Click. Then produce a new invoice for the client. You wish to produce an adjustment billing and you don't wish to delete the initial billing. In this case, you can modify the consultation fee and let the system produce the change invoice.

Click under the visit cost. Enter the updated consultation charge and click. The system will immediately create an adjustment invoice. If you have actually billings set to be produced automatically, this modification billing will be generated overnight. Otherwise, you can produce it by hand by clicking from the upper right corner of the customer's profile.

We advise keeping invoices automation on Daily in order to prevent any billing confusion. Just make certain to make any session fee changes prior to completion of the day so billings produce correctly.

The Best Strategy To Use For Invoice Maker

You have actually done the work; now it's payment time. Here's where your invoice plays a key function. Let's stroll through the process of making an invoice. Prior to preparing a billing, make certain your consumer is anticipating one. If your invoice comes out of nowhere, they might be slow to pay it, and even upset.

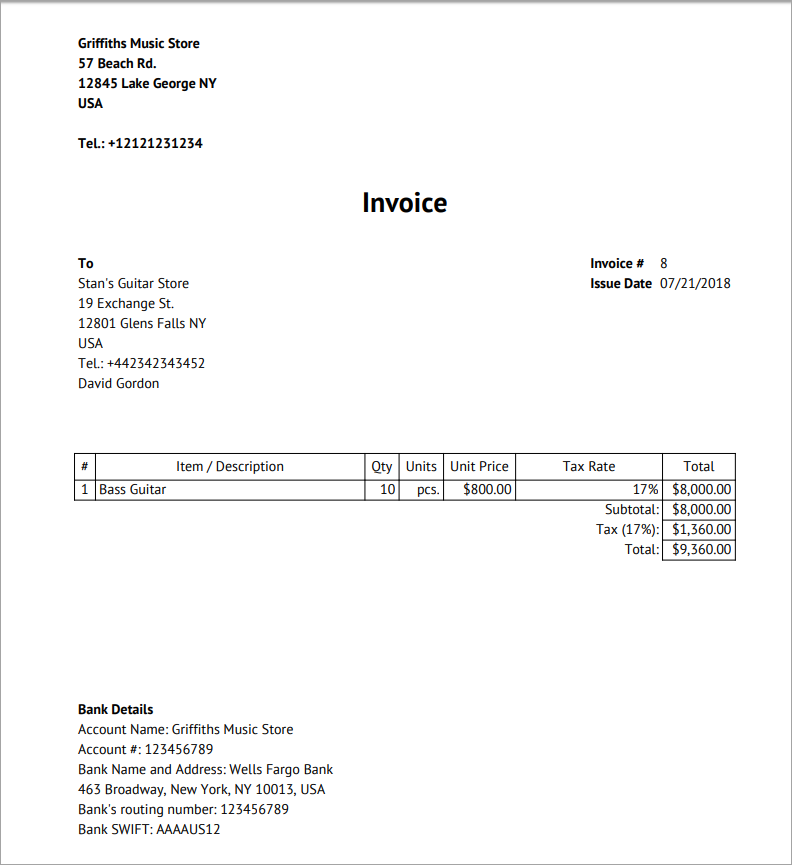

If you don't have an arrangement in location, at least tell them when a billing will be raised. You need to show the seller, the buyer, and what was exchanged. You may likewise be needed to show if you collected tax on the sale. Some of the information, such as your organization name, will remain the very same from one billing to the next.

Not known Details About Create Invoices

You require to have an unique billing number on every expense you send out. This is to assist you, the consumer, or potentially auditors to locate particular billings. An invoice number can be any string of numbers and letters. You can utilize different approaches to produce a billing number, such as: numbering your invoices sequentially, for instance INV00001, INV00002 beginning with an unique customer code, for example XER00001 consisting of the date at the start of your invoice number, for instance 2019-01-001 integrating the client code and date, for example XER-2019-01-001 Your numbering system can help you arrange and browse for previous billings rapidly.