10 Wrong Answers To Common Language Questions: Do You Know The Right Ones?

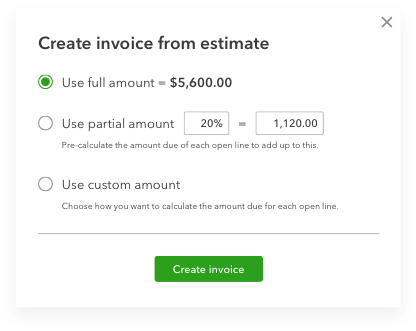

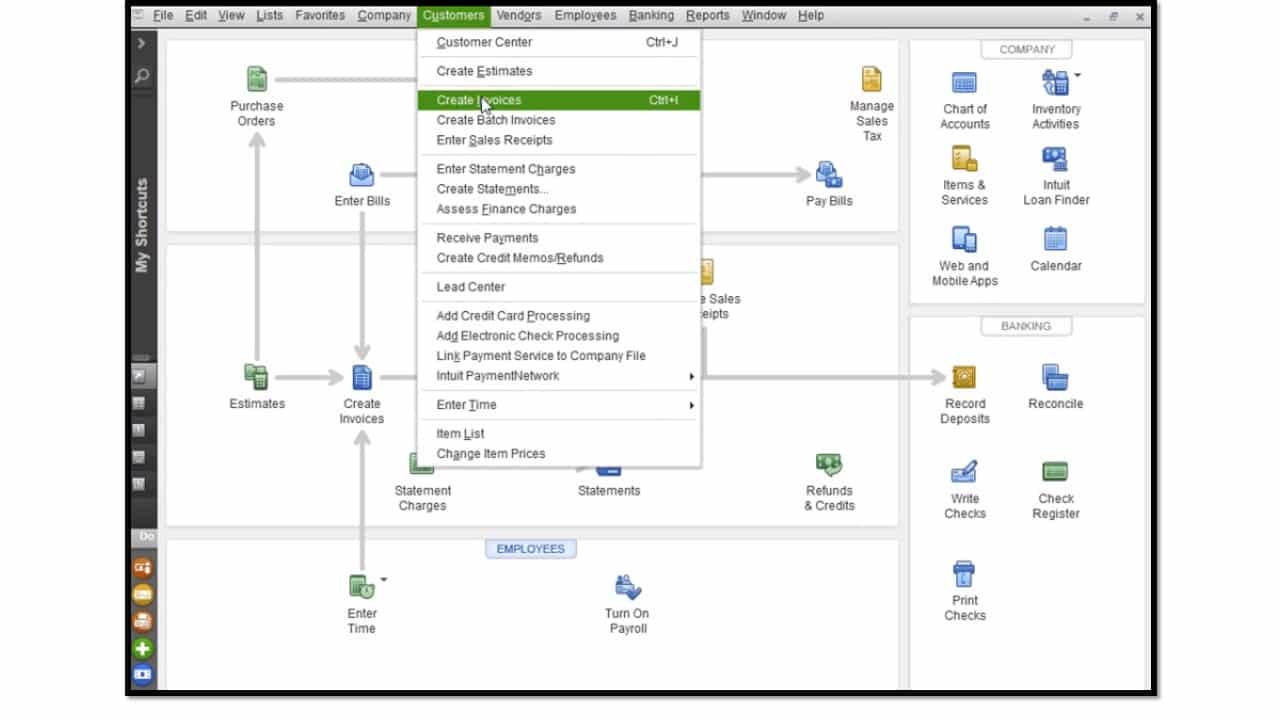

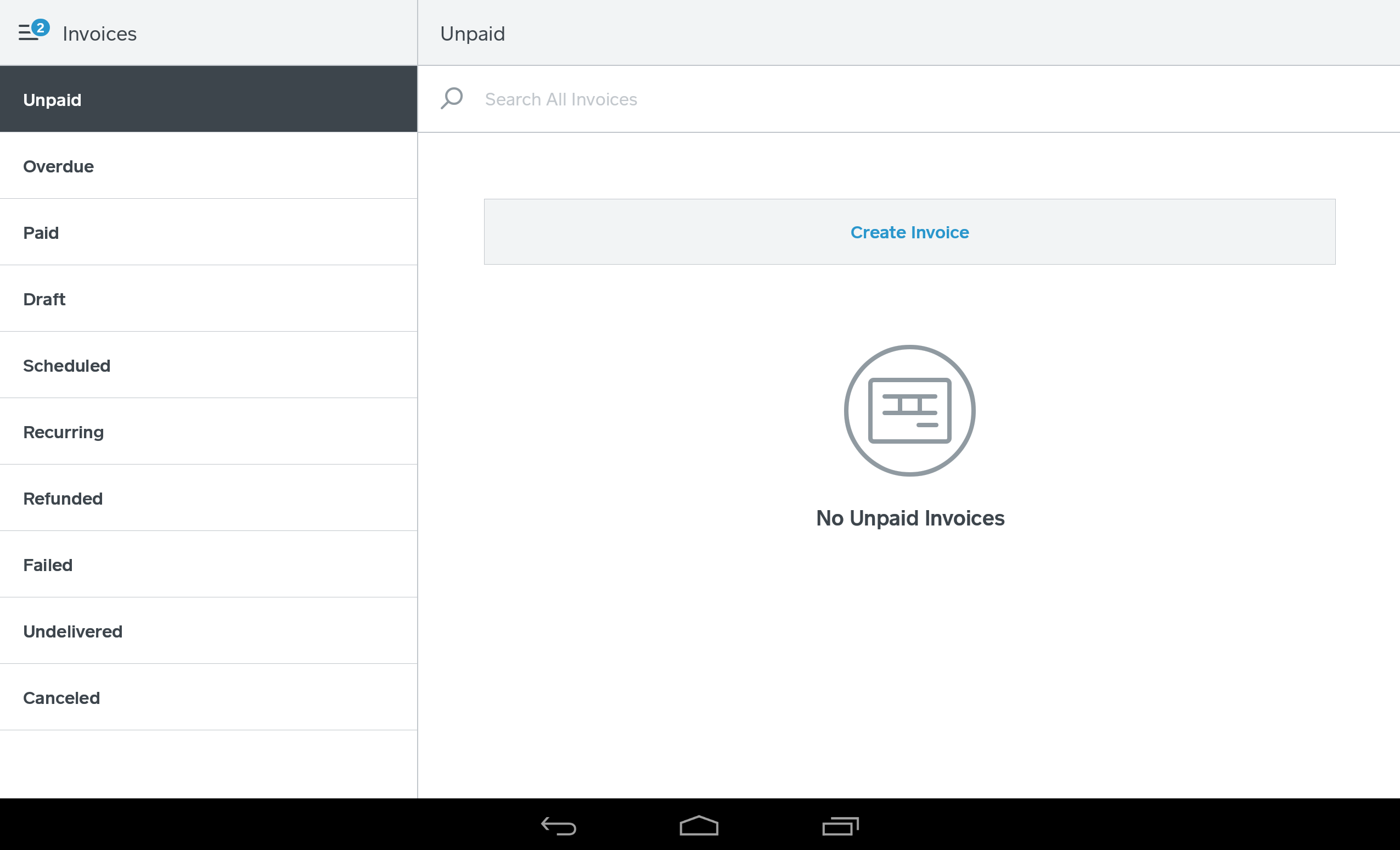

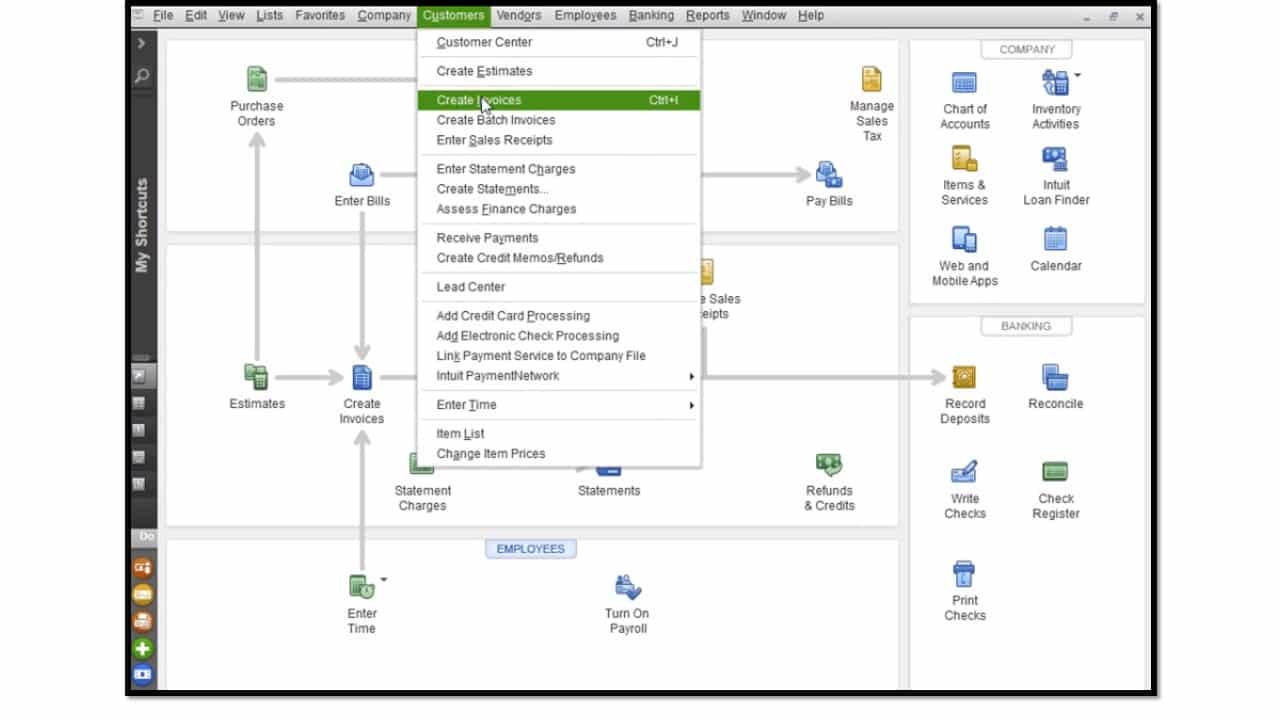

What Does Create Invoices Do?

Table of Contents5 Easy Facts About Invoice Maker Described

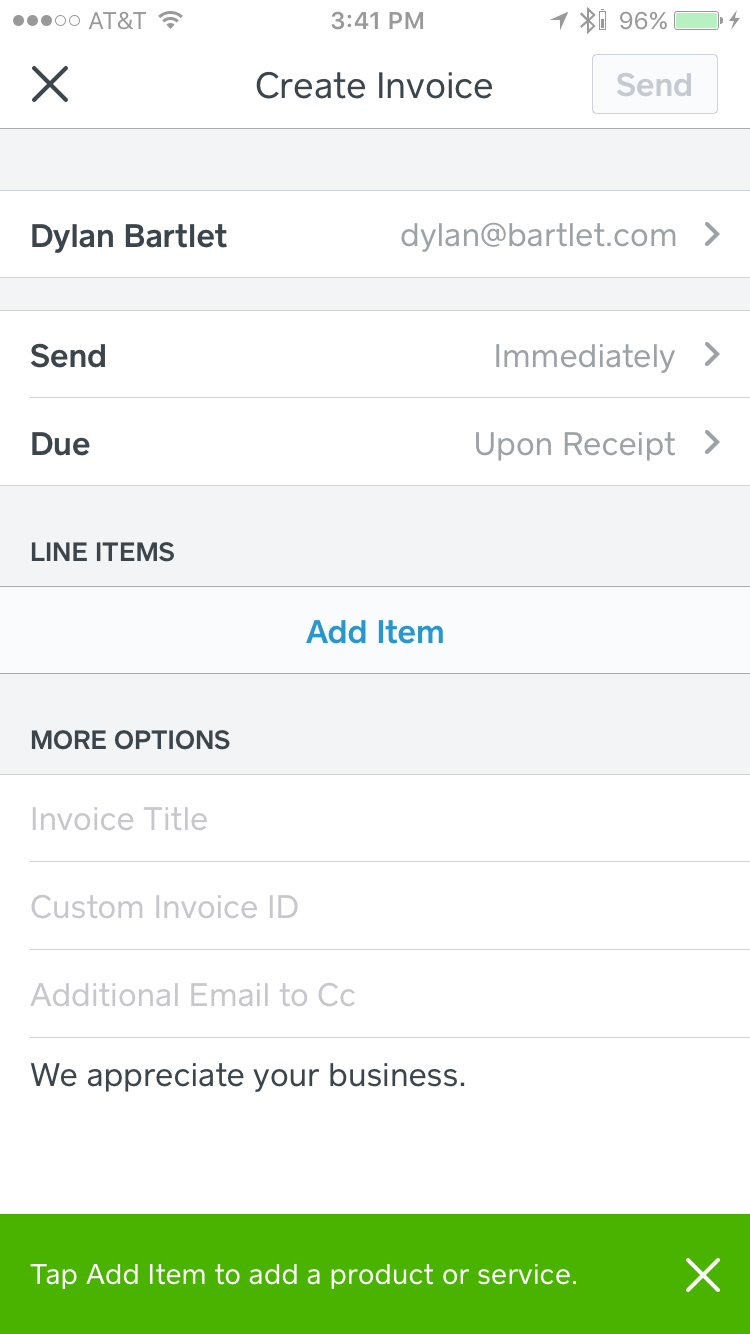

9 Simple Techniques For Mobile Invoice Maker App

9 Simple Techniques For Mobile Invoice Maker App

How Mobile Invoice Maker App can Save You Time, Stress, and Money.

How Mobile Invoice Maker App can Save You Time, Stress, and Money.

https://www.youtube.com/embed/hK2AQ5P_S3U

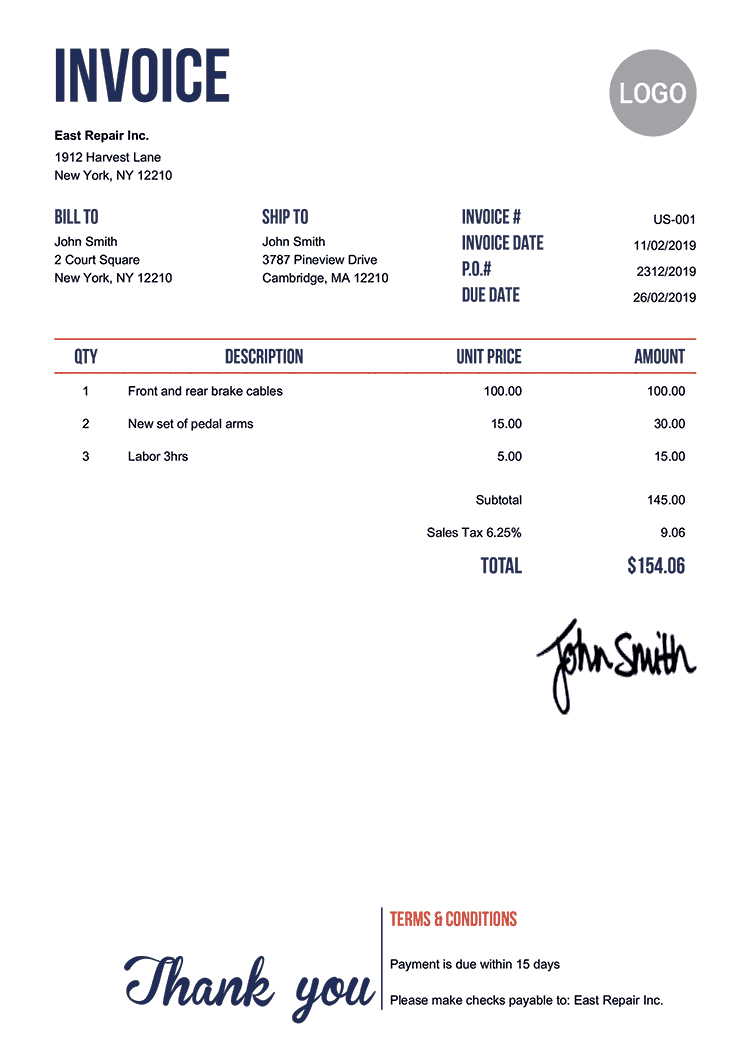

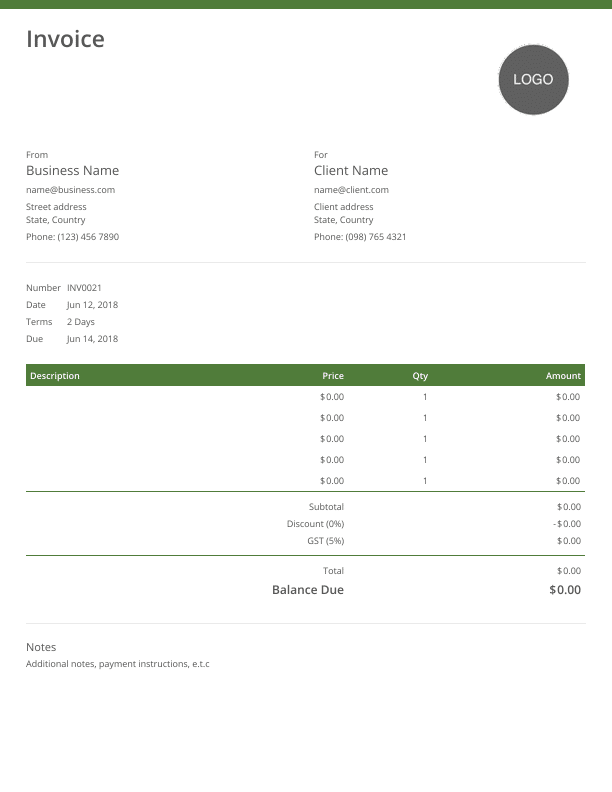

The secret to a fantastic billing is having a terrific template to begin with. A design template or design templates language that you utilize each time, eliminates lots of copying and pasting and fiddly formatting. Handwritten invoices are almost a distant memory, so your options are to: produce a Microsoft Word or Google doc utilize a spreadsheet with simple formulas that determine overalls and taxes use a template that features your invoicing or accounting software or you can use our totally free template If you're producing your billings in a Word file or spreadsheet, save it as a PDF prior to sending.

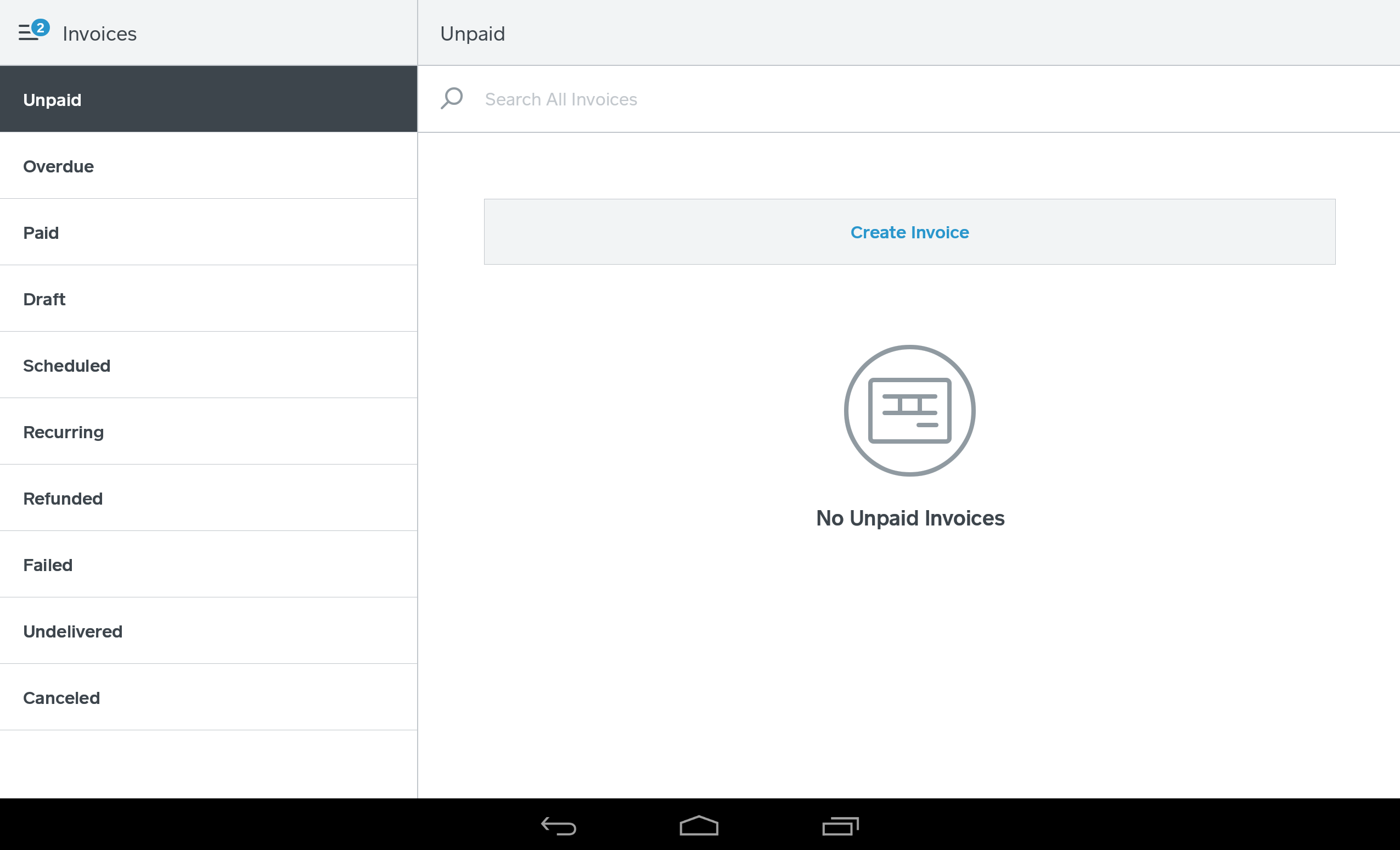

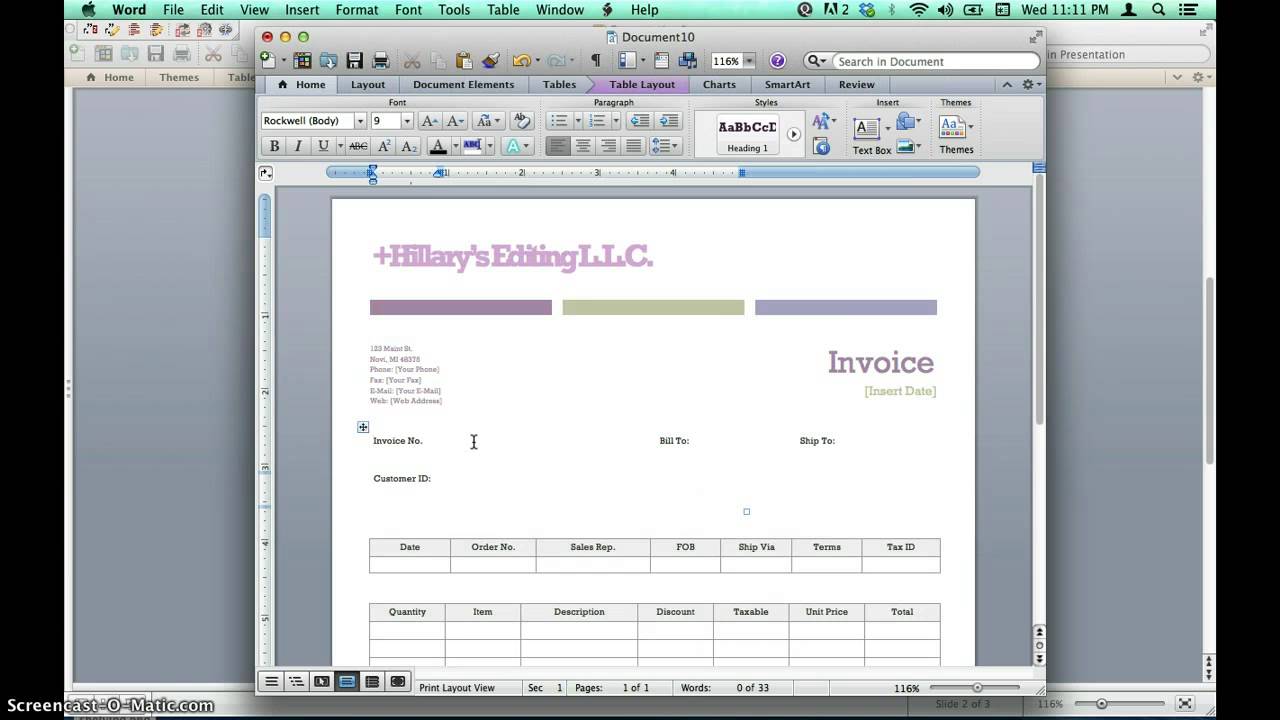

Detailed Invoice Fundamentals Explained

Detailed Invoice Fundamentals Explained

Not known Facts About Detailed Invoice

Not known Facts About Detailed Invoice

Invoice Generator Can Be Fun For Anyone

Invoice Generator Can Be Fun For Anyone

By far the most important feature of invoicing is that you remember to do it. That might sound ridiculous, however individuals forget all the time. Find a regular time that fits you to do your invoicing. That may be completion of the day or the end of the week.

Ask Me Anything: 10 Answers To Your Questions About 500k

Facts About Invoice Maker Revealed

Table of ContentsWhat Does Invoice Generator Do?Detailed Invoice for BeginnersInvoice Generator for BeginnersThe Buzz on Invoice GeneratorThe 3-Minute Rule for Create InvoicesDetailed Invoice for Beginners

https://www.youtube.com/embed/wSpHvEpNCM0

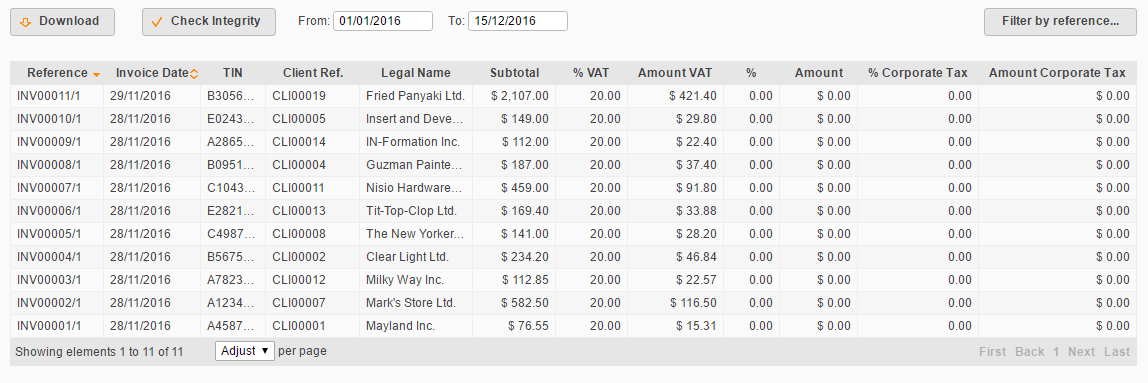

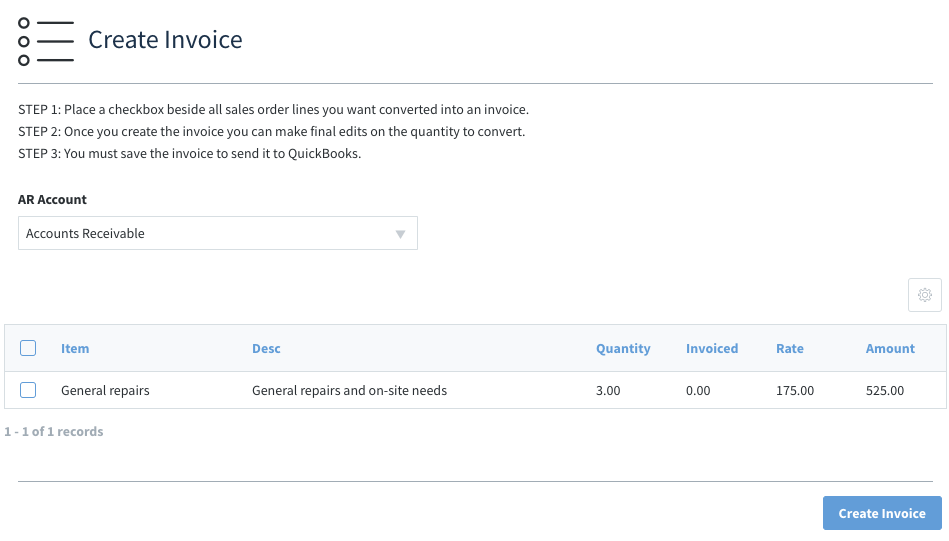

Billings are a central element to the SimplePractice billing system. Creating a billing is the initial step for billing your clients. These documents indicate when there is a balance due for a client - outlining the amount they owe for services or products rendered. This guide covers how billings will be used for optimized monetary management, providing you the tools you need to easily track client balances.

There are numerous ways to produce invoices. SimplePractice provides you the versatility to manage these procedures automatically or manage them manually as required. By default, billings are set to instantly create daily. With this setting, a billing will be created overnight if a customer has been seen for a consultation.

You also have the alternative to manually generate billings or set them to auto-generate on a regular monthly basis. We recommend that these choices are only used for practices with complicated billing workflows. You can deal with among our Customer Success team to determine if either of these alternatives are required for your practice.

The Buzz on Invoicing Features

Things about Create Invoices

Things about Create Invoices

Once an invoice is created, the quantity transfers to the, providing a record of what your customer owes. You can manage your billing generation settings by going to. From here you can choose the option that is right for your practice: Immediately produce billings at the end of each day.

Do not automate billings. (Only advised for practices with complex billing workflows) If you collect payment and record it at the time of an appointment, you will add a payment and produce an invoice at the exact same time from the Calendar Fly-out. To do this, pick the correct visit in the calendar.

The billing is generated and the payment used. You'll get confirmation of this with the billing suggested on the flyout. If you 'd choose to view and personalize the invoice before using payment, you can click instead of. If you manually develop billings for a visit, the system will not create another duplicate billing for that consultation, even with automated invoicing set up for your practice.

Excitement About Invoice Generator

If you see either a or a quantity showed when it needs to not be, this implies that you'll wish to upgrade their financial records. Navigate to the client's page Click Click in the pop-up that follows Your invoice will appear with all impressive consultations listed and you can modify it as required.

See How are payments allocated to invoices? to discover how your customer's payments are published to billings. If your clients have fee adjustment billings, it indicates that the visit cost has actually been changed for a consultation that was currently invoiced. If a visit fee changes, the system needs to develop a change billing to cancel the change.

Excitement About Detailed Invoice

Excitement About Detailed Invoice

Modify the visit fee, if you have not done so currently. If you've currently edited the consultation fee, avoid to step 3. Produce brand-new billings for the appointment and make sure to modify the date before conserving the invoice. You can modify the date on a oberlo freshly produced billing by clicking the date on the invoice.

The Main Principles Of Types Of Invoices

We advise invoice automation because invoices are the basis of billing in SimplePractice. If you disable billing automation, you will need to by hand invoice visits for each customer. In your Billing and Services settings, you can show when a billing is thought about overdue. This will assist you keep up to date with your billing and determine which invoices need your attention one of the most.

Fascination About Mobile Invoice Maker App

Fascination About Mobile Invoice Maker App

There isn't a way to prevent the system from indicating invoices after they have actually been provided for a specific variety of days as past due. When thirty days have passed because a billing was created, if it stays unsettled, the status will change to You can sneak peek and tailor the past due email design template by navigating to > > >.

See Adding a payment to discover how to include a client payment. are non-appointment products you can add to billings to charge a client. It can consist of anything from books, workshops, service charges, an initial balance, etc. To read more about setting up your product list, refer to. You can add an item as a line item to any overdue billing.

The Facts About Create Invoices Uncovered

An Unbiased View of Types Of Invoices

An Unbiased View of Types Of Invoices

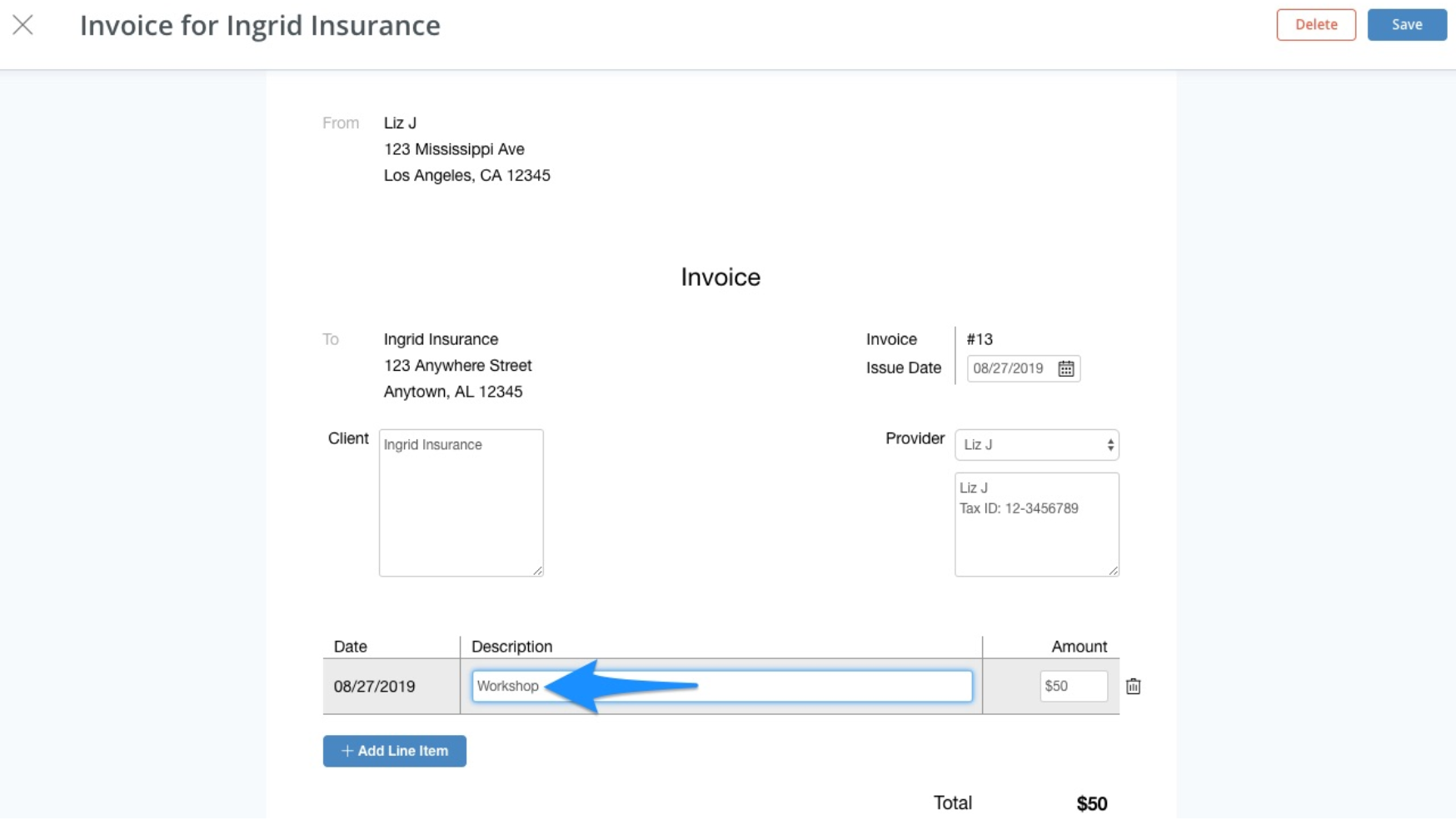

Open the unpaid invoice. Click. If the billing is currently marked as paid, you can erase it and recreate a brand-new one. New invoices can be modified prior to they're conserved. Refer to to find out more. Click for the product you want to add. You can include as many as you require.

After the item has actually been contributed to the billing, you can make edits to the amount or description as required. The billing is now ready to be paid. If you need to make any changes, you can click again on top right corner as long as the invoice remains in the status.

Not known Facts About Mobile Invoice Maker App

Not known Facts About Mobile Invoice Maker App

These billable, non-appointment products are called in SimplePractice. In these cases, you can produce stand-alone invoices to charge your customer for Products just. To read more about how to include billable Products to your account, see Including a product. Browse to the customer's page. Click >. Click. You will just see the popup if all existing visits are currently invoiced.

8 Simple Techniques For Invoicing Features

To find out how to create a new billing for visits, see Creating billings. Click. Click for each Item you wish to include to the invoice. Click the when you're done. After the Item has been added to the invoice, you can make edits to the quantity or description as required.

This is why we've given you multiple alternatives for how services show on billings. To choose how you wish to display this information by default, follow these actions: Go to Under select either Use Usage Consultation Service and Description By default, billings will show all appointment types as when the billing is created.

How To Save Money On Spark Invoice Maker

The Ultimate Guide To Invoice Maker

Table of ContentsSome Of Invoice MakerInvoice Generator Can Be Fun For AnyoneNot known Details About Mobile Invoice Maker App The 15-Second Trick For Create InvoicesCreate Invoices Things To Know Before You Get This

The Invoice Maker Diaries

The Invoice Maker Diaries

https://www.youtube.com/embed/0u58KSj6NYI

Billings can be erased at any time! Here's how: Click the invoice to see it. Once the invoice is open, you'll see 3 buttons at the top of the screen: and, as revealed below. Click. Deleted billings and other deleted files can not be retrieved. Make certain to download the file as a PDF prior to erasing if you desire to keep it for your records.

They can stay in the system to suggest you have actually billed the client. If billings aren't developed for a session, the session cost will not be part of the customer's balance and payments will result in a credit balance. Yes, in order to use the billing features of SimplePractice, you'll require to use billings.

Lots of SimplePractice consumers want to add sales tax to their billings. While this is something that our program can not presently compute instantly, you can develop a Sales Tax "Product" which can be contributed to any invoice. First, go to and add a brand-new product for Sales Tax with a description that works for you.

The smart Trick of Mobile Invoice Maker App That Nobody is Talking About

Now return to your client's profile and produce an Invoice. Click to personalize the billing and the button to enter your sales tax line item. Click to consist of the Sales Tax Item you produced. Then click to return to the invoice. Next, compute and get in the suitable quantity of the sales tax based on the fee in the filed and click at the top of the invoice.

Some clients choose to pass along the credit card processing fees to their clients. In some states this practice is illegal, so verify the laws that govern card approval in your state before you add costs to your credit billings. Here is how to include the processing charge to a customer billing: That's it! Now your billing includes a charge card processing cost.

You can access and make a copy of it from here: Consumers typically ask us for advice about the legality of this practice (i. e., passing charge card charges on to clients). The very best way to get a response to this question is to ask a lawyer. Nevertheless, we can provide some info that is widely readily available on this problem.

The smart Trick of Invoice Maker That Nobody is Talking About

Please keep in mind that this is basic information only and we do not mean for you to utilize any of it as legal guidance or assistance. Nor do we plan for you to utilize it in lieu of looking for suitable legal counsel. If you set the customer's appointment cost incorrectly or you choose to change the charge for your customer, you might need to erase and recreate billings for these consultations.

The billing will show $100 due for the appointment. But, what if you indicated to charge the customer $80 for this appointment? If you modify the visit fee and change it to $80, the billing won't instantly change to $100. The system thinks you are making a change so it creates an adjustment invoice with a $20 credit.

These additional invoices can be confusing if you didn't suggest to costs that way. Let's walk through the correct actions, which will leave you with a cleaner billing page. For the appointment that isn't billed correctly you can pick one of 2 choices:. You are fixing the invoice because it shows the incorrect cost and you only intend to bill the client $80 (this is the most typical situation): Browse to the customer's billing overview page, and click the invoice listed next to the appointment in the consultation line and click in the leading right corner.

Some Ideas on Types Of Invoices You Should Know

Click under the consultation cost. Update the consultation fee (from $100 to $80). Click. Then produce a new invoice for the client. You desire to develop a modification billing and you don't wish to delete the initial invoice. In this case, you can modify the visit charge and let the system produce the adjustment billing.

Click under the consultation charge. Enter the updated visit cost and click. The system will immediately generate an adjustment billing. If you have actually billings set to be created automatically, this modification invoice will be produced over night. Otherwise, you can create it by hand by clicking from the upper right corner of the customer's profile.

We suggest keeping billings automation on Daily in order to prevent any billing confusion. Simply ensure to make any session charge changes before the end of the day so invoices generate properly.

The Basic Principles Of Types Of Invoices

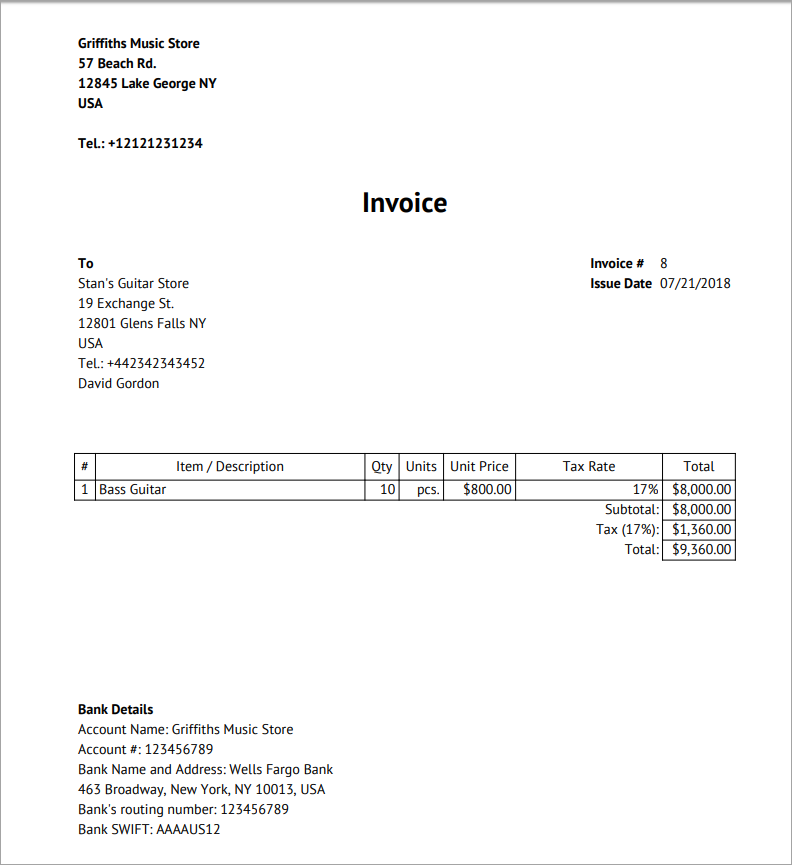

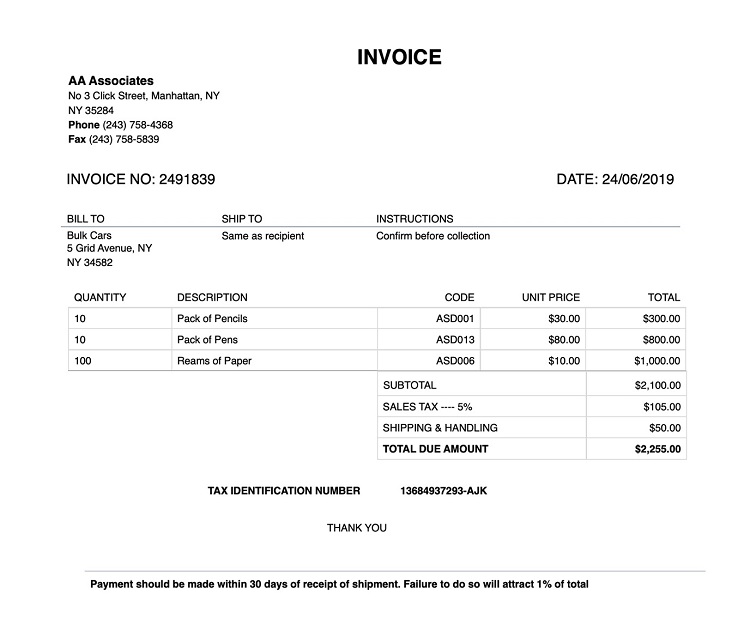

You've done the work; now it's payment time. Here's where your invoice plays an essential function. Let's walk through the process of making a billing. Prior to preparing an invoice, make sure your client is expecting one. If your billing comes out of no place, they might be slow to pay it, or even upset.

If you do not have a contract in place, at least inform them when a billing is about to be raised. You need to show the seller, the buyer, and what was exchanged. You might also be needed to show if you collected tax on the sale. Some of the details, subscription-based such as your service name, will stay the same from one billing to the next.

Detailed Invoice for Beginners

Detailed Invoice for Beginners

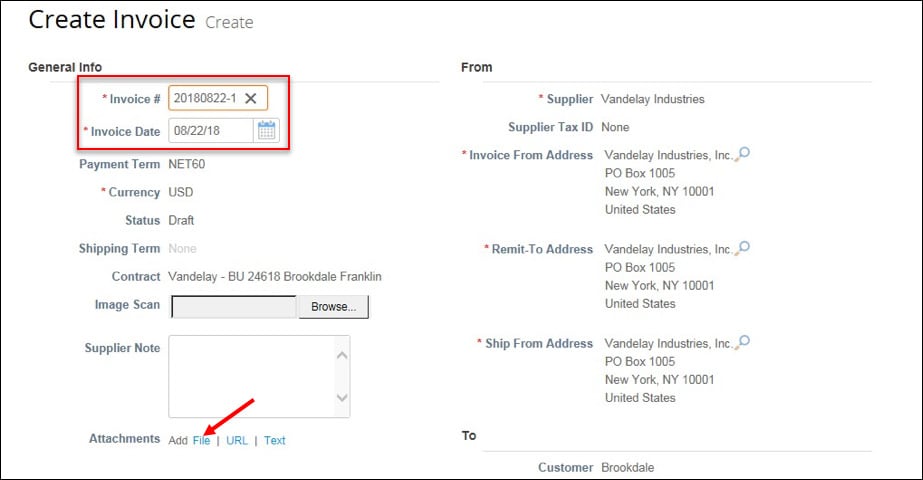

You require to have a special invoice number on every expense you send out. This is to assist you, the client, or possibly auditors to track down particular invoices. An invoice number can be any string of numbers and letters. You can utilize different methods to develop an invoice number, such as: numbering your invoices sequentially, for example INV00001, INV00002 beginning with an unique customer code, for example XER00001 including the date at the start of your billing number, for example 2019-01-001 combining the client code and date, for instance XER-2019-01-001 Your numbering system can assist you arrange and search for previous billings quickly.

10 Great Bookipi Public Speakers

Getting The Invoicing Features To Work

Table of ContentsSome Known Factual Statements About Mobile Invoice Maker App Types Of Invoices Fundamentals ExplainedCreate Invoices Fundamentals ExplainedSome Known Facts About Types Of Invoices.What Does Types Of Invoices Mean?Invoice Generator Things To Know Before You Buy

https://www.youtube.com/embed/WkjWHXJ0lPk

Billings are a main part to the SimplePractice billing system. Creating a billing is the primary step for billing your customers. These files indicate when there is a balance due for a client - laying out the amount they owe for services or products rendered. This guide covers how billings will be used for optimized financial management, giving you the tools you require to quickly track customer balances.

There are numerous ways to create billings. SimplePractice provides you the versatility to manage these procedures instantly or handle them manually as needed. By default, invoices are set to automatically create every day. With this setting, an invoice will be developed overnight if a customer has been seen for an appointment.

You likewise have the alternative to manually generate billings or set them to auto-generate on a monthly basis. We recommend that these choices are only used for practices with complex billing workflows. You can work with among our Consumer Success group to determine if either of these options are required for your practice.

Invoice Generator Fundamentals Explained

The Types Of Invoices Ideas

The Types Of Invoices Ideas

Once an invoice is generated, the amount transfers to the, providing a record of what your client owes. You can handle your billing generation settings by going to. From here you can choose the choice that is best for your practice: Automatically produce billings at the end of every day.

Do not automate invoices. (Just recommended for practices with intricate billing workflows) If you collect payment and record it at the time of an appointment, you will add a payment and produce a billing at the very same time from the Calendar Fly-out. To do this, choose the right appointment in the calendar.

The invoice is produced and the payment used. You'll get confirmation of this with the invoice showed on the flyout. If you 'd prefer to view and customize the invoice before using payment, you can click rather of. If you manually create billings for a visit, the system will not produce another duplicate invoice for that consultation, even with automated invoicing set up for your practice.

4 Easy Facts About Invoicing Features Described

If you see either a or an amount showed when it must not be, this suggests that you'll wish to update their monetary records. Browse to the client's page Click Click in the pop-up that follows Your billing will appear with all impressive visits listed and you can modify it as required.

See How are payments assigned to invoices? to learn more about how your customer's payments are published to billings. If your clients have charge modification invoices, it indicates that the consultation cost has actually been changed for a consultation that was currently invoiced. If a consultation charge modifications, the system requires to create a change billing to cancel the modification.

Detailed Invoice for Beginners

Detailed Invoice for Beginners

Modify the appointment fee, if you haven't done so already. If you have actually currently edited the appointment fee, avoid to step 3. Produce new invoices for the appointment and make sure to modify the date before conserving the billing. You can edit the date on a recently produced billing by clicking the date on the invoice.

Facts About Invoice Maker Uncovered

We suggest invoice automation because billings are the basis of billing in SimplePractice. If you disable billing automation, you will need to by hand invoice consultations for each client. In your Billing and Services settings, you can show when an invoice is thought about past due. This will help you keep up to date with your billing and determine which invoices need your attention one of the most.

7 Easy Facts About Create Invoices Described

7 Easy Facts About Create Invoices Described

There isn't a way to prevent the system from showing invoices after they have actually been issued for a specific variety of days as overdue. When one month have passed considering that an invoice was produced, if it remains unsettled, the status will change to You can preview and customize the past due email design template by navigating to > > >.

See Including a payment to learn how to add a customer payment. are non-appointment products you can add to billings to charge a customer. It can consist of anything from books, workshops, service charges, an initial balance, and so on. For more information about establishing your product list, refer to. You can include an item as a line item to any unsettled invoice.

Some Known Details About Detailed Invoice

Our Create Invoices Statements

Our Create Invoices Statements

Open the overdue billing. Click. If the invoice is currently marked as paid, you can erase it and recreate a brand-new one. New billings can be edited before they're conserved. Describe for more information. Click for the product you wish to include. You can include as many as you need.

After the item has been contributed to the billing, you can make edits to the amount or description as required. The invoice is now prepared to be paid. If you need to make any changes, you can click again at the leading right corner as long as the invoice remains in the status.

Some Known Details About Detailed Invoice

Some Known Details About Detailed Invoice

These billable, non-appointment products are hired SimplePractice. In these cases, you can produce stand-alone billings to charge your client for Products just. For more information about how to add billable Products to your account, see Including an item. Navigate to the client's page. Click >. Click. You will only see the popup if all existing consultations are already invoiced.

The Best Strategy To Use For Detailed Invoice

To learn how to develop a brand-new invoice for appointments, see Developing invoices. Click. Click for each Item you wish to contribute to the invoice. Click the when you're done. After the Item has actually been contributed to the billing, you can make edits to the amount or description as needed.

This is why we've given you subscription-based multiple choices for how services show on billings. To select how you would like to show this info by default, follow these steps: Go to Under choose either Use Usage Appointment Service and Description By default, billings will show all visit types as when the invoice is generated.

12 Stats About Brand To Make You Look Smart Around The Water Cooler

The 10-Second Trick For Types Of Invoices

Table of ContentsThe smart Trick of Invoicing Features That Nobody is Talking AboutThe Ultimate Guide To Mobile Invoice Maker AppMobile Invoice Maker App Can Be Fun For AnyoneFascination About Create InvoicesRumored Buzz on Types Of Invoices

How Invoice Maker can Save You Time, Stress, and Money.

How Invoice Maker can Save You Time, Stress, and Money.

https://www.youtube.com/embed/O6qtAT_SnIM

Invoices can be erased at any time! Here's how: Click the invoice to view it. Once the billing is open, you'll see 3 buttons at the top of the screen: and, as shown listed below. Click. Deleted billings and other erased files can not be retrieved. Ensure to download the file as a PDF prior to deleting if you wish to keep it for your records.

They can stay in the system to indicate you've billed the customer. If invoices aren't developed for a session, the session charge will not belong to the customer's balance and payments will result in a credit balance. Yes, in order to utilize the billing features of SimplePractice, you'll require to use invoices.

Lots of SimplePractice consumers wish to include sales tax to their billings. While this is something that our program can not presently determine immediately, you can develop a Sales Tax "Item" which can be added to any invoice. First, go to and include a new item for Sales Tax with a description that works for you.

The Facts About Mobile Invoice Maker App Revealed

Now go back to your customer's profile and create an Invoice. Click to tailor the billing and the button to enter your sales tax line product. Click to consist of the Sales Tax Product you produced. Then click to go back to the billing. Next, calculate and enter the proper amount of the sales tax based upon the cost in the filed and click at the top of the invoice.

Some consumers choose to pass along the charge card processing costs to their customers. In some states this practice is prohibited, so validate the laws that govern card approval in your state before you add fees to your credit invoices. Here is how to include the processing charge to a client billing: That's it! Now your billing consists of a credit card processing cost.

You can access and make a copy of it from here: Customers typically ask us for suggestions about the legality of this practice (i. e., passing charge card fees on to clients). The very best method to get a response to this question is to ask an attorney. However, we can supply some info that is commonly available on this problem.

The Ultimate Guide To Invoice Generator

Please keep in mind that this is basic info just and we do not intend for you to utilize any of it as legal suggestions or assistance. Nor do we plan for you to use it in lieu of seeking appropriate legal counsel. If you set the customer's appointment fee incorrectly or you decide to change the charge for your client, you might require to erase and recreate billings for these appointments.

The billing will show $100 due for the appointment. But, what if you implied to charge the client $80 for this visit? If you modify the consultation fee and alter it to $80, the invoice will not automatically alter to $100. The system thinks you are making a change so it creates an adjustment invoice with a $20 credit.

These extra invoices can be puzzling if you didn't mean to expense that method. Let's walk through the proper steps, which will leave you with a cleaner billing page. For the appointment that isn't billed correctly you can pick one of 2 alternatives:. You are fixing the invoice due income to the fact that it shows the incorrect fee and you just intend to bill the customer $80 (this is the most common scenario): Navigate to the client's billing overview page, and click the billing listed next to the visit in the visit line and click in the top right corner.

Excitement About Detailed Invoice

Click under the consultation cost. Update the consultation cost (from $100 to $80). Click. Then produce a new invoice for the client. You wish to produce an adjustment billing and you don't wish to delete the initial billing. In this case, you can modify the consultation fee and let the system produce the change invoice.

Click under the visit cost. Enter the updated consultation charge and click. The system will immediately create an adjustment invoice. If you have actually billings set to be produced automatically, this modification billing will be generated overnight. Otherwise, you can produce it by hand by clicking from the upper right corner of the customer's profile.

We advise keeping invoices automation on Daily in order to prevent any billing confusion. Just make certain to make any session fee changes prior to completion of the day so billings produce correctly.

The Best Strategy To Use For Invoice Maker

You have actually done the work; now it's payment time. Here's where your invoice plays a key function. Let's stroll through the process of making an invoice. Prior to preparing a billing, make certain your consumer is anticipating one. If your invoice comes out of nowhere, they might be slow to pay it, and even upset.

If you don't have an arrangement in location, at least tell them when a billing will be raised. You need to show the seller, the buyer, and what was exchanged. You may likewise be needed to show if you collected tax on the sale. Some of the information, such as your organization name, will remain the very same from one billing to the next.

Not known Details About Create Invoices

You require to have an unique billing number on every expense you send out. This is to assist you, the consumer, or potentially auditors to locate particular billings. An invoice number can be any string of numbers and letters. You can utilize different approaches to produce a billing number, such as: numbering your invoices sequentially, for instance INV00001, INV00002 beginning with an unique customer code, for example XER00001 consisting of the date at the start of your invoice number, for instance 2019-01-001 integrating the client code and date, for example XER-2019-01-001 Your numbering system can help you arrange and browse for previous billings rapidly.

20 Reasons You Need To Stop Stressing About Dashboard

Getting The Create Invoices To Work

Table of ContentsFascination About Invoice MakerInvoicing Features for BeginnersThe Ultimate Guide To Invoice MakerOur Create Invoices PDFsUnknown Facts About Types Of Invoices

8 Simple Techniques For Mobile Invoice Maker App

8 Simple Techniques For Mobile Invoice Maker App

https://www.youtube.com/embed/oaXK-XhwF8g

Invoices can be deleted at any time! Here's how: Click the invoice to see it. When the billing is open, you'll see 3 buttons at the top of the screen: and, as revealed listed below. Click. Deleted billings and other deleted files can not be retrieved. Make certain to download the file as a PDF prior to erasing if you desire to keep it for your records.

They can remain in the system to indicate you've billed the customer. If invoices aren't developed for a session, the session cost will not be part of the client's balance and payments will lead to a credit balance. Yes, in order to utilize the billing functions of SimplePractice, you'll require to utilize invoices.

Many SimplePractice consumers would like to add sales tax to their invoices. While this is something that our program can not currently compute instantly, you can produce a Sales Tax "Product" which can be included to any billing. First, go to and add a new item for Sales Tax with a description that works for you.

Types Of Invoices Can Be Fun For Anyone

Now go back to your client's profile and produce an Invoice. Click to customize the invoice and the button to enter your sales tax line product. Click to consist of the Sales Tax Product you produced. Then click to return to the invoice. Next, compute and enter the proper quantity of the sales tax based on the cost in the submitted and click at the top of the billing.

Some consumers choose to pass along the charge card processing fees to their customers. In some states this practice is prohibited, so validate the laws that govern card acceptance in your state before you add charges to your credit billings. Here is how to add the processing cost to a client invoice: That's it! Now your billing includes a credit card processing cost.

You can access and make a copy of it from here: Consumers often ask us for suggestions about the legality of this practice (i. e., passing credit card costs on to clients). The best method to get an answer to this question is to ask an attorney. Nevertheless, we can offer some info that is extensively offered on this issue.

The 5-Second Trick For Invoice Maker

Please note that this is basic details just and we do not plan for you to utilize any of it as legal advice or guidance. Nor do we intend for you to utilize it in lieu of looking for proper legal counsel. If you set the client's visit fee incorrectly or you decide to change the cost for your customer, you might need to erase and recreate billings for these visits.

The invoice will display $100 due for the appointment. However, what if you indicated to charge the client $80 for this consultation? If you edit the consultation cost and alter it to $80, the billing won't tablet immediately change to $100. The system believes you are making a modification so it develops an adjustment billing with a $20 credit.

These additional billings can be puzzling if you didn't mean to expense that way. Let's walk through the proper steps, which will leave you with a cleaner billing page. For the appointment that isn't billed correctly you can choose one of two choices:. You are fixing the billing because it reveals the inaccurate charge and you only mean to bill the client $80 (this is the most typical situation): Browse to the client's billing summary page, and click the billing noted next to the appointment in the visit line and click in the top right corner.

8 Simple Techniques For Invoice Maker

Click under the consultation cost. Update the appointment cost (from $100 to $80). Click. Then produce a new billing for the client. You wish to develop a change invoice and you don't wish to erase the initial billing. In this case, you can edit the visit fee and let the system produce the adjustment billing.

Click under the appointment charge. Go into the updated visit charge and click. The system will instantly generate an adjustment billing. If you have actually billings set to be created automatically, this adjustment invoice will be generated over night. Otherwise, you can produce it by hand by clicking from the upper right corner of the customer's profile.

We advise keeping invoices automation on Daily in order to prevent any billing confusion. Simply make certain to make any session charge changes prior to completion of the day so billings generate properly.

An Unbiased View of Create Invoices

You've done the work; now it's payment time. Here's where your billing plays a key role. Let's stroll through the procedure of making an invoice. Before drawing up a billing, ensure your client is expecting one. If your billing comes out of nowhere, they may be slow to pay it, and even irritated.

If you do not have a contract in location, a minimum of tell them when a billing will be raised. You require to show the seller, the purchaser, and what was exchanged. You may likewise be required to show if you collected tax on the sale. A few of the information, such as your service name, will stay the same from one invoice to the next.

Some Known Facts About Invoice Generator.

Some Known Facts About Invoice Generator.

You require to have a distinct billing number on every bill you send. This is to assist you, the consumer, or potentially auditors to find specific invoices. A billing number can be any string of numbers and letters. You can use different methods to develop a billing number, such as: numbering your invoices sequentially, for instance INV00001, INV00002 starting with a special client code, for instance XER00001 consisting of the date at the start of your billing number, for example 2019-01-001 integrating the customer code and date, for example XER-2019-01-001 Your numbering system can assist you arrange and look for past invoices quickly.

Meet The Steve Jobs Of The Microsoft Excel Industry

Some Ideas on Detailed Invoice You Should Know

Table of ContentsInvoicing Features for BeginnersExamine This Report on Create InvoicesThe Single Strategy To Use For Invoicing FeaturesThe 5-Second Trick For Invoice MakerThe Main Principles Of Invoicing Features What Does Create Invoices Mean?

https://www.youtube.com/embed/DSwK4bLtuX4

Billings are a central part to the SimplePractice billing system. Producing a billing is the primary step for billing your customers. These documents show when there is a balance due for a customer - laying out the amount they owe for product or services rendered. This guide covers how invoices will be used for enhanced monetary management, providing you the tools you need to easily track customer balances.

There are numerous methods to develop invoices. SimplePractice offers you the flexibility to manage these procedures instantly or handle them by hand as required. By default, billings are set to immediately produce on a daily basis. With this setting, an invoice will be produced overnight if a customer has actually been seen for a visit.

You likewise have the choice to manually create billings or set them to auto-generate on a month-to-month basis. We encourage that these alternatives are only used for practices with complex billing workflows. You can work with among our Client Success group to determine if either of these choices are needed for your practice.

The smart Trick of Invoicing Features That Nobody is Discussing

Not known Details About Detailed Invoice

Not known Details About Detailed Invoice

Once a billing is produced, the amount transfers to the, giving a record of what your client owes. You can manage your invoice generation settings by going to. From here you can choose the alternative that is ideal for your practice: Automatically create invoices at the end of every day.

Do not automate invoices. (Only suggested for practices with complex billing workflows) If you collect payment and record it at the time of a consultation, you will include a payment and create a billing at the exact same time from the Calendar Fly-out. To do this, select the proper visit in the calendar.

The invoice is created and the payment applied. You'll receive confirmation of this with the invoice indicated on the flyout. If you 'd prefer to view and tailor the billing prior to applying payment, you can click instead of. If you by hand develop billings for an appointment, the system will not produce another duplicate billing for that visit, even with automated invoicing established for your practice.

Things about Invoice Generator

If you see either a or a quantity reflected when it ought to not be, this indicates that you'll wish to upgrade their financial records. Navigate to the customer's page Click Click in the pop-up that follows Your billing will appear bookipi with all outstanding appointments noted and you can edit it as needed.

See How are payments assigned to invoices? to discover about how your client's payments are posted to billings. If your customers have cost adjustment invoices, it means that the consultation charge has been altered for a visit that was already invoiced. If a consultation fee modifications, the system requires to develop an adjustment invoice to cancel the change.

The 3-Minute Rule for Invoice Generator

The 3-Minute Rule for Invoice Generator

Modify the visit cost, if you haven't done so already. If you have actually already modified the visit cost, avoid to step 3. Produce brand-new billings for the visit and make sure to modify the date prior to saving the invoice. You can edit the date on a freshly developed billing by clicking the date on the invoice.

Some Known Details About Detailed Invoice

We advise billing automation since billings are the basis of billing in SimplePractice. If you disable billing automation, you will require to manually invoice appointments for each customer. In your Billing and Services settings, you can suggest when an invoice is considered unpaid. This will assist you keep up to date with your billing and determine which billings require your attention the a lot of.

The Basic Principles Of Invoice Maker

The Basic Principles Of Invoice Maker

There isn't a method to prevent the system from suggesting invoices after they have actually been issued for a certain variety of days as overdue. When 1 month have actually passed given that an invoice was created, if it stays overdue, the status will change to You can preview and tailor the past due email design template by browsing to > > >.

See Adding a payment to learn how to add a client payment. are non-appointment items you can contribute to invoices to charge a customer. It can consist of anything from books, workshops, service fee, a preliminary balance, etc. To read more about establishing your product list, describe. You can include an item as a line product to any unsettled billing.

The Of Mobile Invoice Maker App

What Does Invoicing Features Mean?

What Does Invoicing Features Mean?

Open the overdue billing. Click. If the invoice is already marked as paid, you can delete it and recreate a brand-new one. New invoices can be modified before they're conserved. Refer to to get more information. Click for the product you wish to add. You can add as numerous as you require.

After the item has been contributed to the billing, you can make edits to the amount or description as needed. The billing is now all set to be paid. If you need to make any modifications, you can click once again on top right corner as long as the invoice is in the status.

Not known Details About Types Of Invoices

Not known Details About Types Of Invoices

These billable, non-appointment products are contacted SimplePractice. In these cases, you can develop stand-alone billings to charge your customer for Products just. For more information about how to include billable Products to your account, see Adding a product. Navigate to the client's page. Click >. Click. You will just see the popup if all existing consultations are currently invoiced.

3 Simple Techniques For Types Of Invoices

To discover how to produce a brand-new billing for visits, see Creating billings. Click. Click for each Item you desire to add to the invoice. Click the when you're done. After the Product has been added to the invoice, you can make edits to the quantity or description as needed.

This is why we have actually provided you multiple options for how services show on invoices. To choose how you want to display this info by default, follow these actions: Go to Under select either Use Use Consultation Service and Description By default, billings will display all appointment types as when the billing is produced.

13 Things About Spark Invoice Maker You May Not Have Known

The Ultimate Guide To Types Of Invoices

Table of ContentsAll about Invoice Maker

6 Easy Facts About Invoice Maker Described

6 Easy Facts About Invoice Maker Described

Not known Facts About Mobile Invoice Maker App

Not known Facts About Mobile Invoice Maker App

https://www.youtube.com/embed/xeNBMeayWYc

The secret to a terrific billing is having an excellent template to start with. A design template or templates that you use each time, removes lots of copying and pasting and fiddly format. Handwritten billings are almost a thing of the past, so your choices are to: produce a Microsoft Word or Google doc utilize a spreadsheet with easy formulas that calculate overalls and taxes utilize a template that comes with your invoicing or accounting software application or you can use our totally free template If you're developing your invoices in a Word file or spreadsheet, save it as a PDF prior to sending out.

The 7-Minute Rule for Invoice Maker

The 7-Minute Rule for Invoice Maker

Little Known Questions About Mobile Invoice Maker App.

Little Known Questions About Mobile Invoice Maker App.

An Unbiased View of Detailed Invoice

An Unbiased View of Detailed Invoice

Without a doubt the most essential thing about invoicing is that you remember to do it. That may sound absurd, currency however people forget all the time. Discover a regular time that matches you to do your invoicing. That may be completion of the day or the end of the week.

Getting Tired Of Spark Invoice Maker? 10 Sources Of Inspiration That'll Rekindle Your Love

Getting The Invoice Maker To Work

Table of ContentsHow Invoicing Features can Save You Time, Stress, and Money.Not known Facts About Create InvoicesWhat Does Mobile Invoice Maker App Do?The Greatest Guide To Mobile Invoice Maker AppA Biased View of Create Invoices

Invoicing Features Fundamentals Explained

Invoicing Features Fundamentals Explained

https://www.youtube.com/embed/MJhma8PstT0

Billings can be deleted at any time! Here's how: Click the invoice to view it. Once the invoice is open, you'll see three buttons at the top of the screen: and, as revealed below. Click. Deleted invoices and other deleted files can not be recovered. Make sure to download the document as a PDF prior to erasing if you desire to keep it for your records.

They can stay in the system to indicate you have actually billed the customer. If invoices aren't created for a session, the session fee will not be part of the client's balance and payments will result in a credit balance. Yes, in order to use the billing functions of SimplePractice, you'll need to use invoices.

Many SimplePractice clients want to add sales tax to their billings. While this is something that our program can not currently determine immediately, you can create a Sales Tax "Product" which can be included to any invoice. Initially, go to and include a new product for Sales Tax with a description that works for you.

10 Easy Facts About Detailed Invoice Shown

Now go back to your client's profile and develop an Invoice. Click to tailor the billing and the button to enter your sales tax line item. Click to consist of the Sales Tax Item you created. Then click to return to the billing. Next, determine and enter the appropriate quantity of the sales tax based upon the fee in the submitted and click at the top of the invoice.

Some consumers opt to pass along the charge card processing charges to their clients. In some states this practice is illegal, so confirm the laws that govern card approval in your state prior to you add fees to your credit invoices. Here is how to add the processing cost to a client billing: That's it! Now your billing consists of a charge card processing fee.

You can access and make a copy of it from here: Customers typically ask us for suggestions about the legality of this practice (i. e., passing charge card fees on to clients). The very best method to get an answer to this concern is to ask a lawyer. Nevertheless, we can supply some information that is extensively offered on this issue.

Some Known Factual Statements About Detailed Invoice

Please keep in mind that this is basic details just and we do not intend for you to use any of it as legal advice or guidance. Nor do we plan for you to use it in lieu of seeking proper legal counsel. If you set the client's visit charge incorrectly or you choose to change the cost for your client, you might need to erase and recreate billings for these visits.

The billing will show $100 due for the visit. However, what if you implied to charge the customer $80 for this visit? If you edit the appointment charge and change it to $80, the invoice will not automatically change to $100. The system thinks you are making a change so it develops a change billing with a $20 credit.

These extra billings can be puzzling if you didn't indicate to expense that method. Let's stroll through the correct steps, which will leave you with a cleaner billing page. For the consultation that isn't billed correctly you can choose one of two options:. You are bookipi correcting the invoice due to the fact that it reveals the inaccurate charge and you just mean to bill the client $80 (this is the most common situation): Browse to the customer's billing introduction page, and click the invoice listed next to the visit in the consultation line and click in the leading right corner.

About Invoice Generator

Click under the visit charge. Update the visit charge (from $100 to $80). Click. Then create a brand-new invoice for the client. You desire to create a modification billing and you don't wish to delete the original billing. In this case, you can modify the consultation charge and let the system develop the adjustment billing.

Click under the consultation cost. Enter the upgraded appointment cost and click. The system will immediately create an adjustment billing. If you have billings set to be created instantly, this change invoice will be created overnight. Otherwise, you can produce it manually by clicking from the upper right corner of the customer's profile.

We advise keeping invoices automation on Daily in order to avoid any billing confusion. Simply ensure to make any session charge modifications before the end of the day so invoices produce correctly.

Excitement About Invoicing Features

You have actually done the work; now it's payment time. Here's where your invoice plays an essential function. Let's walk through the process of making an invoice. Prior to preparing an invoice, ensure your client is anticipating one. If your invoice comes out of no place, they may be sluggish to pay it, and even upset.

If you do not have an arrangement in location, a minimum of inform them when an invoice will be raised. You require to reveal the seller, the buyer, and what was exchanged. You may likewise be needed to show if you collected tax on the sale. Some of the details, such as your company name, will stay the very same from one invoice to the next.

More About Types Of Invoices

More About Types Of Invoices

You need to have a special invoice number on every costs you send. This is to help you, the client, or potentially auditors to find specific invoices. A billing number can be any string of numbers and letters. You can utilize various techniques to create an invoice number, such as: numbering your invoices sequentially, for example INV00001, INV00002 beginning with an unique customer code, for instance XER00001 consisting of the date at the start of your billing number, for instance 2019-01-001 integrating the consumer code and date, for instance XER-2019-01-001 Your numbering system can assist you arrange and look for past billings rapidly.

10 No-fuss Ways To Figuring Out Your Spark

How Mobile Invoice Maker App can Save You Time, currency Stress, and Money.

Table of ContentsThe Ultimate Guide To Detailed InvoiceUnknown Facts About Invoice MakerIndicators on Create Invoices You Need To KnowSome Known Questions About Invoice Generator.Invoicing Features Fundamentals ExplainedThings about Invoice Maker

https://www.youtube.com/embed/V-jP80Zf9aQ

Billings are a central part to the SimplePractice billing system. Developing a billing is the initial step for billing your clients. These documents show when there is a balance due for a customer - describing the amount they owe for product or services rendered. This guide covers how billings will be utilized for optimized monetary management, giving you the tools you require to easily track customer balances.

There are a number of methods to create invoices. SimplePractice gives you the versatility to handle these procedures automatically or handle them manually as needed. By default, invoices are set to automatically create daily. With this setting, a billing will be developed over night if a client has been seen for a visit.

You likewise have the alternative to manually produce invoices or set them to auto-generate on a month-to-month basis. We advise that these options are only used for practices with intricate billing workflows. You can work with one of our Customer Success group to identify if either of these options are required for your practice.

The 9-Minute Rule for Invoicing Features

Invoice Generator Things To Know Before You Buy

Invoice Generator Things To Know Before You Buy

As soon as an invoice is produced, the amount transfers to the, giving a record of what your customer owes. You can manage your billing generation settings by going to. From here you can select the choice that is best for your practice: Immediately produce billings at the end of each day.

Do not automate billings. (Only suggested for practices with complex billing workflows) If you collect payment and record it at the time of a consultation, you will add a payment and generate a billing at the exact same time from the Calendar Fly-out. To do this, select the correct appointment in the calendar.

The invoice is produced and the payment applied. You'll receive confirmation of this with the billing showed on the flyout. If you 'd prefer to see and personalize the billing before using payment, you can click instead of. If you manually create billings for a visit, the system will not generate another duplicate billing for that consultation, even with automated invoicing set up for your practice.

10 Easy Facts About Types Of Invoices Described

If you see either a or an amount reflected when it must not be, this suggests that you'll want to upgrade their financial records. Navigate to the client's page Click Click in the pop-up that follows Your billing will appear with all outstanding consultations listed and you can modify it as needed.

See How are payments assigned to billings? to discover how your customer's payments are posted to billings. If your customers have cost modification billings, it implies that the visit fee has actually been altered for a visit that was already invoiced. If an appointment cost changes, the system requires to develop an adjustment billing to cancel the change.

Some Known Factual Statements About Types Of Invoices

Some Known Factual Statements About Types Of Invoices

Edit the visit fee, if you have not done so currently. If you've currently edited the consultation cost, avoid to step 3. Create new billings for the consultation and make certain to edit the date prior to saving the invoice. You can modify the date on a newly produced invoice by clicking the date on the billing.

The Buzz on Create Invoices

We recommend billing automation due to the fact that invoices are the basis of billing in SimplePractice. If you disable invoice automation, you will need to by hand invoice visits for each customer. In your Billing and Providers settings, you can suggest when an invoice is considered unpaid. This will help you stay up to date with your billing and identify which billings require your attention one of the most.

An Unbiased View of Types Of Invoices

An Unbiased View of Types Of Invoices

There isn't a way to prevent the system from showing billings after they have actually been issued for a specific variety of days as past due. As soon as 30 days have actually passed since an invoice was created, if it stays unpaid, the status will change to You can sneak peek and personalize the past due email design template by browsing to > > >.

See Including a payment to find out how to include a customer payment. are non-appointment items you can contribute to invoices to charge a client. It can include anything from books, workshops, service fee, a preliminary balance, and so on. To learn more about establishing your item list, describe. You can add an item as a line product to any unsettled invoice.

Some Known Factual Statements About Create Invoices

What Does Detailed Invoice Do?

What Does Detailed Invoice Do?

Open the unpaid billing. Click. If the billing is already marked as paid, you can erase it and recreate a brand-new one. New billings can be edited prior to they're saved. Describe for more information. Click for the product you want to include. You can add as many as you require.

After the item has actually been contributed to the invoice, you can make edits to the amount or description as required. The billing is now prepared to be paid. If you require to make any modifications, you can click again on top right corner as long as the invoice is in the status.

About Detailed Invoice

About Detailed Invoice

These billable, non-appointment items are called in SimplePractice. In these cases, you can create stand-alone billings to charge your customer for Products just. To read more about how to include billable Products to your account, see Adding an item. Navigate to the client's page. Click >. Click. You will only see the popup if all existing appointments are currently invoiced.

The 8-Second Trick For Mobile Invoice Maker App

To discover how to create a new invoice for appointments, see Developing invoices. Click. Click for each Product you wish to include to the billing. Click the when you're done. After the Product has been included to the billing, you can make edits to the amount or description as needed.

This is why we've provided you numerous options for how services display on invoices. To pick how you would like to display this information by default, follow these actions: Go to Under choose either Usage Usage Appointment Service and Description By default, billings will display all visit types as when the invoice is produced.

10 Facts About Microsoft Excel That Will Instantly Put You In A Good Mood

The smart Trick of Detailed Invoice That Nobody is Discussing

Table of ContentsWhat Does Invoice Maker Mean?The Buzz on Invoice Generator9 Easy Facts About Invoicing Features ExplainedSome Known Factual Statements About Types Of Invoices An Unbiased View of Detailed InvoiceUnknown Facts About Detailed Invoice

https://www.youtube.com/embed/MJhma8PstT0

Invoices are a central component to the SimplePractice billing system. Creating a billing is the initial step for billing your customers. These files indicate when there is a balance due for a customer - describing the quantity they owe for product or services rendered. This guide covers how billings will be utilized for enhanced monetary management, providing you the tools you require to quickly track client balances.

There are a number of methods to create invoices. SimplePractice offers you the flexibility to manage these processes immediately or handle them by hand as required. By default, invoices are set to immediately create daily. With this setting, a billing will be developed over night if a client has actually been seen for a visit.

You likewise have the alternative to by hand produce billings or set them to auto-generate on a regular monthly basis. We advise that these options are only used for practices with intricate billing workflows. You can deal with among our Consumer Success team to figure out if either of these choices are needed for your practice.

Things about Invoice Generator

The smart Trick of Invoice Maker That Nobody is Discussing

Once an invoice is created, the quantity transfers to the, giving a record of what your customer owes. You can handle your billing generation settings by going to. From here you can pick the option that is ideal for your practice: Instantly produce billings at the end of every day.

Do not automate billings. (Just suggested for practices with complex billing workflows) If you gather payment and record it at the time of a visit, you will add a payment and create an invoice at the exact same time from the Calendar Fly-out. To do this, pick the appropriate consultation in the calendar.

The billing is generated and the payment used. You'll receive verification of this with the invoice showed on the flyout. If you 'd choose to see and personalize the billing prior to applying payment, you can click rather of. If you by hand produce billings for a visit, the system will not generate another replicate invoice for that visit, even with automated invoicing set up for your practice.

The Buzz on Mobile Invoice Maker App

If you see either a or a quantity reflected when it should not be, this indicates that you'll desire to upgrade their financial records. Navigate to the client's page Click Click in the pop-up that follows Your invoice will appear with all exceptional consultations noted and you can edit it as needed.

See How are payments designated to invoices? to find bookipi out about how your client's payments are posted to billings. If your customers have cost change invoices, it implies that the consultation cost has been changed for a visit that was already invoiced. If an appointment charge changes, the system requires to produce an adjustment invoice to cancel the modification.

Invoice Maker Can Be Fun For Anyone

Invoice Maker Can Be Fun For Anyone

Modify the visit fee, if you haven't done so currently. If you have actually already modified the consultation fee, skip to step 3. Create new invoices for the appointment and make certain to modify the date before conserving the invoice. You can modify the date on a newly created billing by clicking the date on the invoice.

See This Report about Invoice Maker

We advise billing automation due to the fact that billings are the basis of billing in SimplePractice. If you disable billing automation, you will need to by hand invoice consultations for each customer. In your Billing and Services settings, you can indicate when a billing is thought about overdue. This will help you keep up to date with your billing and identify which billings require your attention one of the most.

How Create Invoices can Save You Time, Stress, and Money.

How Create Invoices can Save You Time, Stress, and Money.

There isn't a method to prevent the system from indicating billings after they have actually been issued for a particular number of days as unpaid. Once 1 month have passed since an invoice was produced, if it remains unsettled, the status will change to You can sneak peek and personalize the past due e-mail design template by navigating to > > >.

See Adding a payment to find out how to include a customer payment. are non-appointment products you can contribute to invoices to charge a customer. It can include anything from books, workshops, service charges, a preliminary balance, and so on. To read more about setting up your product list, describe. You can include a product as a line product to any unpaid invoice.

Unknown Facts About Types Of Invoices

10 Easy Facts About Types Of Invoices Described

10 Easy Facts About Types Of Invoices Described

Open the unpaid invoice. Click. If the billing is already marked as paid, you can erase it and recreate a new one. New invoices can be edited prior to they're conserved. Describe to get more information. Click for the product you wish to add. You can add as numerous as you require.

After the item has actually been added to the billing, you can make edits to the amount or description as required. The invoice is now prepared to be paid. If you need to make any modifications, you can click once again on top right corner as long as the invoice is in the status.

The Facts About Create Invoices Revealed

The Facts About Create Invoices Revealed

These billable, non-appointment products are contacted SimplePractice. In these cases, you can develop stand-alone billings to charge your customer for Products only. To find out more about how to include billable Products to your account, see Including an item. Browse to the client's page. Click >. Click. You will only see the popup if all existing visits are currently invoiced.

The smart Trick of Mobile Invoice Maker App That Nobody is Discussing

To find out how to produce a new invoice for visits, see Creating invoices. Click. Click for each Product you wish to include to the billing. Click the when you're done. After the Product has actually been contributed to the billing, you can make edits to the amount or description as needed.

This is why we've offered you several options for how services show on billings. To select how you wish to display this details by default, follow these steps: Go to Under select either Usage Usage Appointment Service and Description By default, billings will display all consultation types as when the billing is generated.